We can all basically agree that redeveloping burned-out, seedy corners of town is a good thing. I’m not talking about the kitschy, urban-hip burned-out that stands opposite of gentrification. Real stuff. A sea of parking lots with a long-ignored island of a building in the middle, for instance.

If you’d like to speak intelligently about all that, you should know about TIFs.

TIF stands for tax increment financing. A TIF is a noun, and a tax tool to spur redevelopment and infill in places like downtown Louisville, where it’s badly needed if we’re going to start acting like the 16th- or 26th-largest city in America or whatever.

So what is a TIF? Basically, it’s a tax scheme that allows a developer to recoup a percentage of its building costs based on the future taxability of its development. For instance, a rundown shithole is now bringing in virtually zero money in property and occupational taxes, because the property is worthless and no one is working there. Insert a bar, bowling alley, restaurant and cinema and suddenly you’ve got some value. And you have employees, who pay a small percentage to the city to work here.

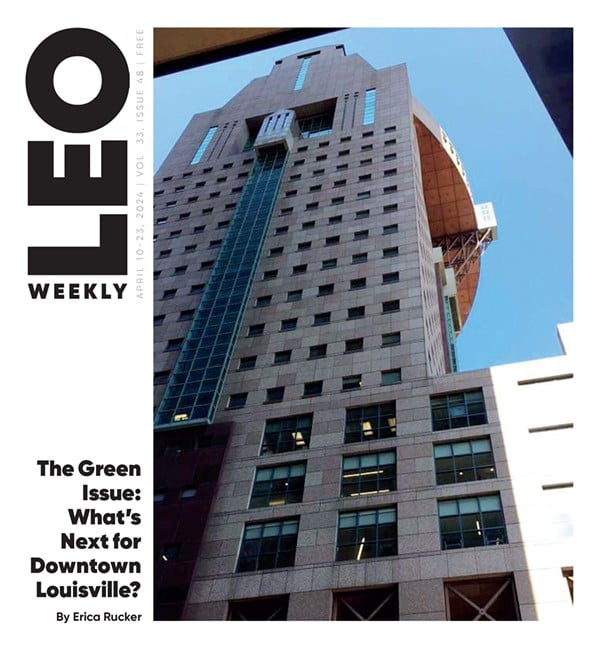

Center City, as it’s named for now, is a prime example. That’s the massive new retail, entertainment and residential complex that will fill those beautiful parking lots where the old Water Company building is. The TIF for Center City includes roughly four city blocks and will total $130 million — just more than half what Cordish, the developer, is laying down up front to get it going.

The Metro Council is likely to approve this TIF, as it has done with the others. After state approval, 80 percent of the new city property taxes and 80 percent of the new city occupational taxes will go back to Cordish. The state’s contribution would include income tax, property tax and sales tax. When it hits the magic number, it stops. Then all new revenue goes to the city.

Oh, and this: “Tax money will not, for example, pay for the condos Cordish is going to build, or pay for the new high-end furniture store they’re going to bring downtown,” Chris Poynter, a spokesman for Mayor Abramson, told me. Instead, that money will be used for public infrastructure improvements, like sidewalks and lighting.

Right now there are two active TIFs in the Metro: the Marriott Hotel downtown, which includes only the plot that the building sits on, and the Renaissance Zone, south of Louisville International Airport. Churchill Downs had one to help fund its recent expansion, but it was never activated.

If all goes as planned, there will soon be four more: The U of L Life Sciences complex at the former Haymarket site, the downtown arena, Museum Plaza and Center City. Excepting the arena*, they all work basically the same way.

City officials tell me that’ll be all for now.

TIFs have been used forever in America, which means since the early 1950s, when ever-progressive California started getting into them. Chicago, a city rife with (plagued by?) development, has 131 of them.

TIF funding is essentially new money, as anyone who likes TIFs will tell you. That money wouldn’t be coming to city coffers without the developments it’s helping to fund — hell, it’s not going to city coffers anyway.

TIFs also reflect a city’s priorities. In this case, it’s building downtown up again. Yes, the new money could be going to schools, or to fund that new library expansion taxpayers also might be about to underwrite. But that raises the chicken-or-egg question: Is there enough confidence in downtown Louisville’s market to bring $200 million-plus developments without tax giveaways?

“TIFs are a good way for us to be able to encourage development and to be able to leverage the increase in tax revenue that we will get with future revenue,” David Tandy, the 4th district councilman, told me. The TIFs on the table now are in his district.

That is to say, not quite yet, but maybe soon. For now, may the local media continue interminably promoting this idea.

*There’s not room here to get into that one — maybe next time.

Contact the writer at

[email protected]